December 29, 2014

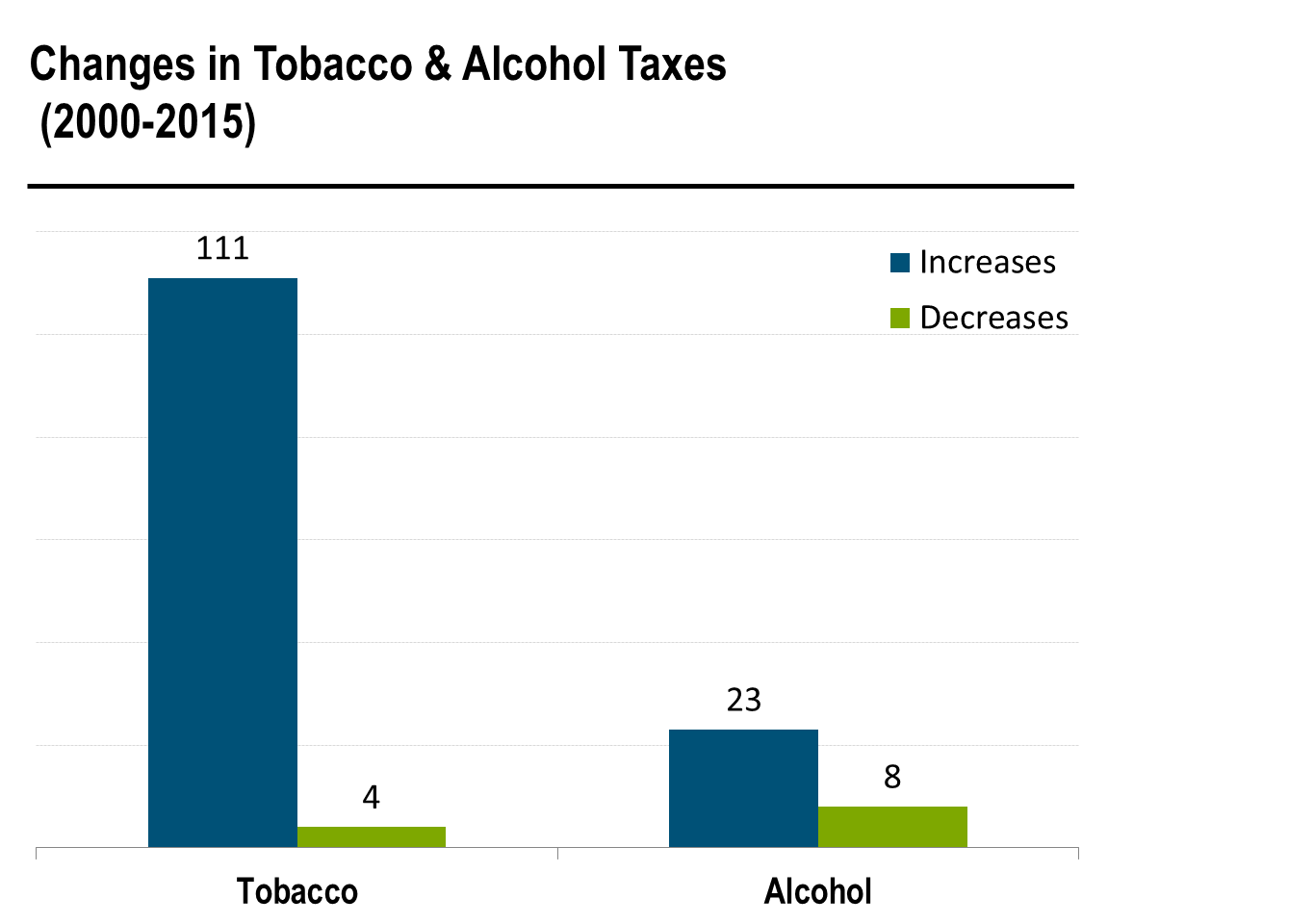

As revelers begin to plan their New Year’s Eve celebrations, many people will be paying considerably more in tobacco and alcohol taxes than they did when worrying about Y2K. This is especially true for people that will be celebrating the New Year by lighting up a cigar or other tobacco product. According to data collected from NASBO’s Fiscal Survey of States, states have enacted increases on cigarette and tobacco taxes a combined 111 times from fiscal 2000 through fiscal 2015. In contrast, states have increased taxes on alcoholic beverages a combined 23 times during the same time period. The number of times states have increased taxes on tobacco and alcohol has far outweighed the times states have cut taxes on these products. States have only reduced cigarette and tobacco taxes four times since 2000 while cutting alcohol taxes eight times.

The increases on cigarette and tobacco taxes have been very widespread, with 45 states enacting at least one tax increase on tobacco products since 2000. On the other hand, only 16 states have enacted any form of tax or fee increase on alcoholic beverages.

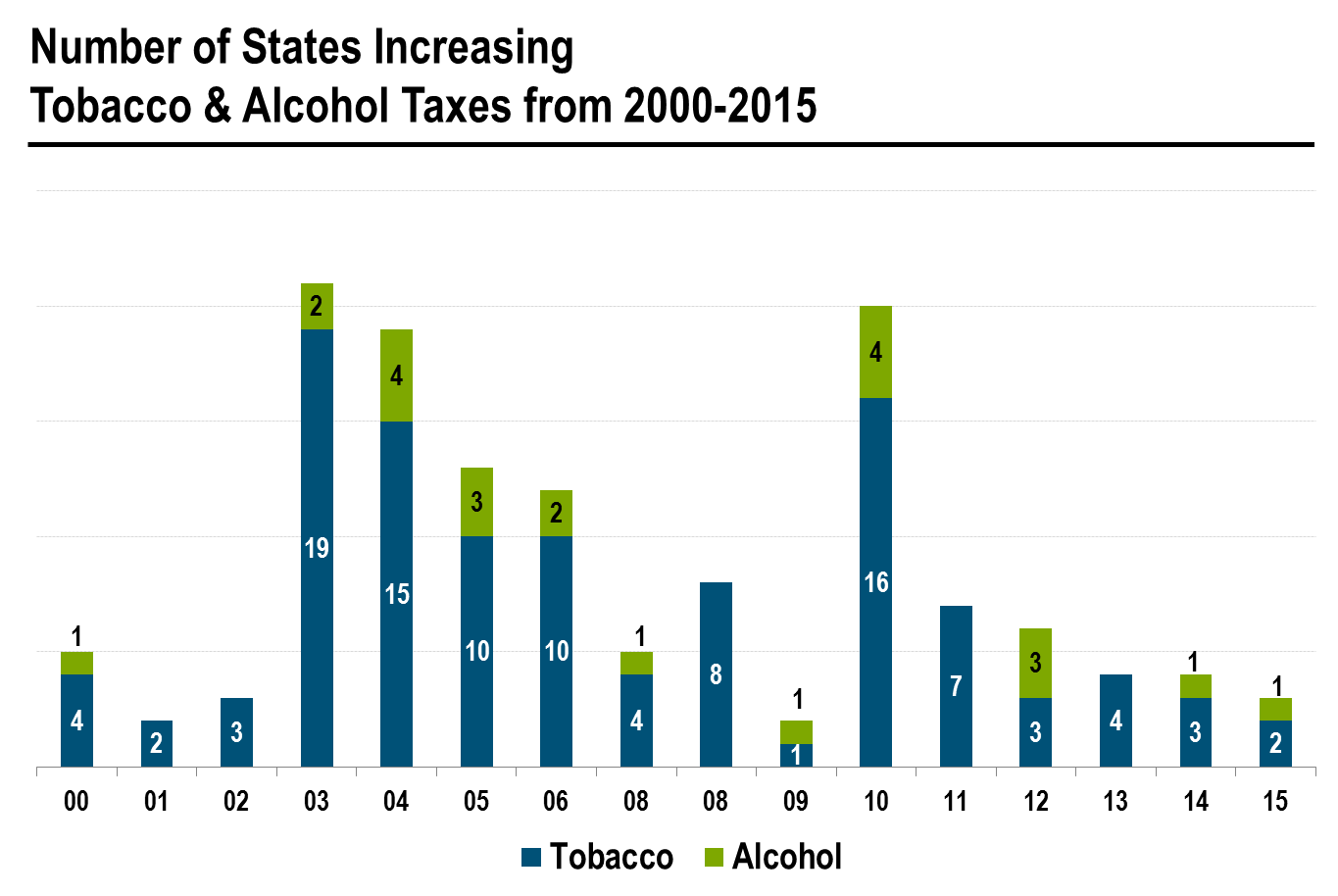

Perhaps not surprisingly, the years during or immediately following a recession saw the largest number of excise tax increases as states have faced shortfalls. For example, 19 states increased taxes on tobacco products in fiscal 2003, 15 states in fiscal 2004, and 16 states in fiscal 2010.